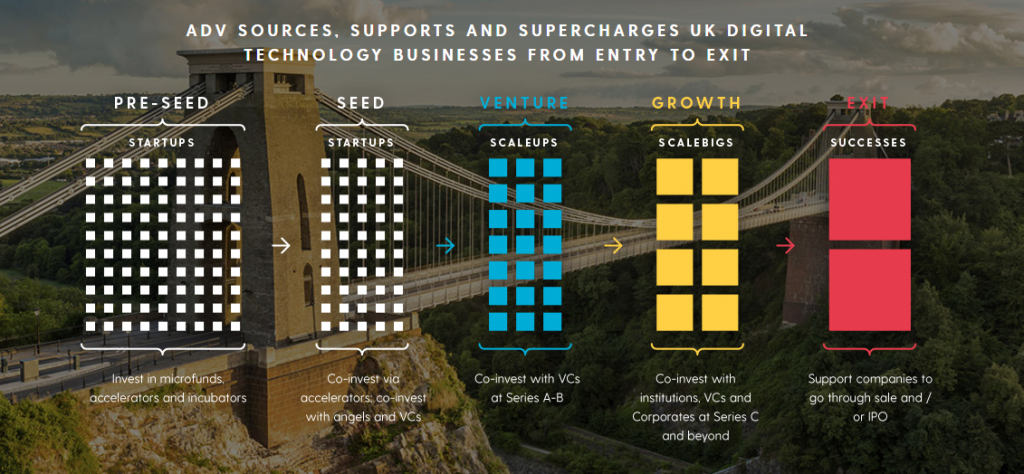

Today marks the launch of Accelerated Digital Ventures (ADV), a new venture platform that will fund all stages of the digital technology business life cycle, from entry to exit.

Led by the founder of Plusnet and Dotforge, Lee Strafford, ADV looks to initially deploy £150 million into businesses across all UK regions with the long term aim of investing £200 million a year via its Evergreen Platform.

“We have established ADV to help more of our emerging startups and scaleups to ‘scalebig’. There are world class innovators in every corner of the UK. We intend to seek out the best investment opportunities at scale and ensure these companies, irrelevant of size and location, have the support they need to supercharge growth,” says Lee.

The platform is being funded by 3 institutional investment partners - the British Business Bank, Legal & General (L&G) and Woodford Investment Management.

It marks a departure from the typical VC model; an investment platform in it's own right, ADV moves away from the need to be continuously thinking about raising a fund (it's not a fund) and allows it the freedom to invest at all stages of the startup's life cycle.

The British Business Bank Enterprise Capital Funds (ECFs) are commercially-focused funds which bring together private and public money to make equity investments in high growth businesses. ADV is partially funded by the 23rd such ECF in the programme.

Keith Morgan, CEO of British Business Bank, said: “This new venture platform, supported by our Enterprise Capital Funds programme, will help innovative digital technology businesses to startup and scaleup rapidly and successfully throughout all stages of their development. We are pleased to be a part of this exciting new venture, and look forward to seeing businesses across the UK benefiting from the much needed long-term funding it will provide.”

The ADV team is made up of industry experts and proven entrepreneurs with extensive experience of scaling businesses across all stages and across the globe. The team includes:

● Lee Strafford, CEO - founder of Plusnet and Dotforge.

● Keith Teare, Chair - founder of Easynet, RealNames, Archimedes Labs and cofounder

of TechCrunch.

● Mike Dimelow, VP Investment - formerly VP of Strategic Business Development

at ARM Ltd.

● David Carr, VP Finance and Operations - co-founder of Dotforge and CitiLogik,

formerly SVP Access for AOL UK.

● Frank DiGiammarino, VP Ecosystem Development - formerly Director in the

World Wide Public Sector Team at Amazon Web Services, and Deputy Director

of the US Recovery Implementation Office which reported to US Vice President

Biden.

● Andy Mulvenna, Investment Lead - founder of Brightpearl.

● Jamie Coleman, Investment Lead - founder of Codebase.

● David Fogel, Investment Lead - formerly Deputy Director and Head of

Acceleration at Wayra UK

In last week’s Autumn Statement, Chancellor of the Exchequer Philip Hammond remarked that economic growth in the UK has been concentrated in London and the South East for too long. The ADV funding model will support the Government's attempts to rebalance this by spreading investment capital right across the country and powering a new generation of ‘scalebig’ businesses that will drive UK competitiveness in a post-Brexit landscape.